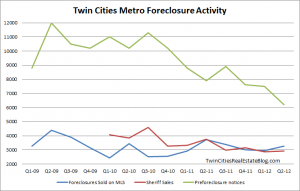

I?m a huge data nerd. ?I stare at charts and data almost daily to get a better sense of what?s going on in the housing market. ?One of the more interesting datasets I look at is foreclosure activity. ?Between the preforeclosure notices published by the Minnesota Home Ownership Center, the sheriff sale data published by HousingLink and the MLS foreclosure sales from MAAR, we can build a very good picture of foreclosure activity over the last few years:

Data from MN Home Ownership Center, HousingLink and Minneapolis Area Association of REALTORS (via MLS sales).

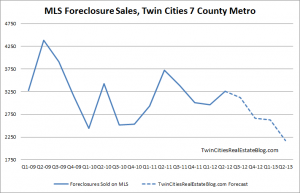

But this data can do more than just show current foreclosure activity, it can also predictably forecast future foreclosure activity. ?Let me show you how:

Preforeclosures

Before a lender can foreclose on a property in Minnesota, they need to send an official notice of foreclosure to the property owner. ?This notice is often 3+ months before a sheriff sale actually occurs. ?As you can see from the chart above, not all preforeclosure notices end in a foreclosure. ?Often there can be several preforeclosure notices sent before an actual sheriff sale occurs.

Sheriff Sales

Once a sheriff sale occurs, most owners have 6 months to Redeem the property, meaning to pay the lender all that is owed. ?After that 6 months, the bank takes the property back and prepares it for sale, which can take another 1-3 months.

Adding it up

If we add these times up (3+6+3) we can estimate the numbers of Twin Cities foreclosure home sales up to 12 months from now:

?What about Shadow Inventory?

I?ve debunked the shadow inventory dangers?here and here. ?Still don?t believe me? ?Take a peek at the Minneapolis Federal Reserve?s report from April 2011 showing the precipitous drop in Minnesota mortgage delinquencies from their highs. ?Delinquencies have continued to decline which should lend itself to even fewer preforeclosures and sheriff sales in 2013.

Source: http://www.twincitiesrealestateblog.com/2012/twin-cities-fewer-foreclosures-in-2013/

jesus montero hiroki kuroda kuroda nfl scores nfl scores gene hackman pineda

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.